SC Jobs Tax Credit Overview

The New Jobs Credit is an income tax credit for creating new jobs in South Carolina. This credit can help offset up to 50% of a taxpayer’s income tax liability.

The New Jobs Tax Credit is a valuable financial incentive that rewards new or expanding companies for creating jobs in South Carolina.

To qualify, companies must create and maintain a certain number of net new jobs in a taxable year. The number of new jobs is calculated as the increase in the average monthly employment from one year to the next.

TaxCredible works with small to medium-sized businesses and their CPA firm to apply for the credit.

Generally, the required new job creation minimum is 10 new full-time jobs (average monthly headcount compared to the prior year). However, Hotels and Motels require at least 20 new full-time jobs and certain Qualifying Service-related facilities must create 25 to 175 new full-time jobs. Professional Sports Teams must create 150 new full-time jobs.

If the taxpayer has less than 100 employees worldwide, the required new job creation minimum is 2 new full-time job

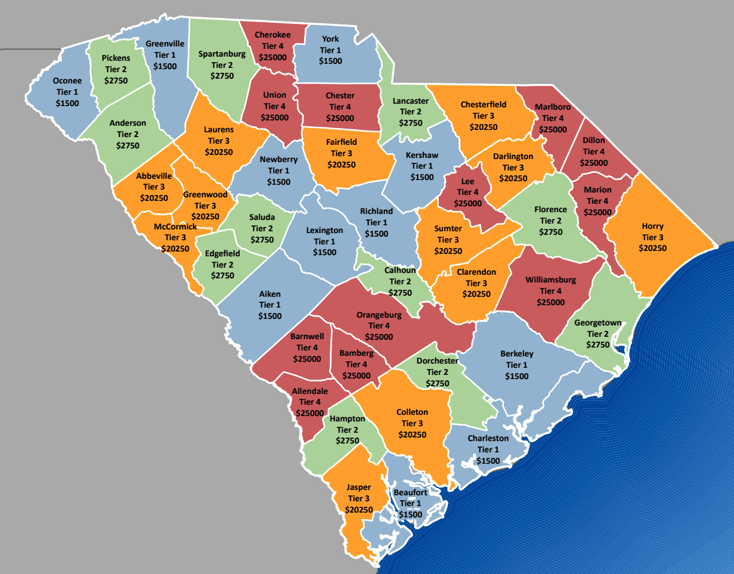

Amount of the Tax Credit:- Tier IV - $25,000 per new full-time job created

- Tier III - $20,250 per new full-time job created

- Tier II - $2,750 per new full-time job created

- Tier I - $1,500 per new full-time job created

Example:

Example: ABC Company operates a warehousing facility in a Tier IV county. The company created 12 new full-time jobs in 2021. ABC Company has a $300,000 credit per year for five years starting in 2022. This total credit over five years amounts to $1,500,000, assuming they maintain the new full-time jobs.